For owner-operators, understanding non-trucking liability insurance is crucial as it provides essential coverage for activities outside freight transport, such as personal drives or local hauls. Affordable owner-operator insurance options like bobtail policies offer tailored protection for reduced operational needs, simplifying the insurance process while keeping premiums low. By knowing local laws and considering specific coverages, owner-operators can ensure compliance, minimize financial exposure, and maintain peace of mind during non-commercial truck use.

In today’s competitive trucking industry, understanding non-trucking liability is crucial for owner-operators seeking affordable owner-operator insurance. This comprehensive guide explores critical coverage options, specifically tailored for owner-operators facing unique risks. We delve into ‘bobtail insurance’ as a game-changer in enhancing risk protection without breaking the bank. Additionally, we navigate claims processes and legalities, equipping you with essential knowledge to make informed decisions regarding your trucking business’s financial security.

Understanding Non-Trucking Liability: Coverage for Owner-Operators

For owner-operators, understanding non-trucking liability is crucial as it provides essential coverage for operations outside traditional trucking activities. This type of insurance is designed to protect individuals who use their trucks for personal or other non-commercial purposes. Since owner-operators are self-employed, they bear the brunt of financial risks when involved in accidents during non-work-related drives. Affordable owner-operator insurance offers a safety net, ensuring they’re not left financially exposed. It covers damages to third parties and their property, offering peace of mind while navigating the roads for personal or recreational uses.

Non-trucking liability insurance is distinct from commercial trucking policies, which primarily focus on operations related to freight transport. It’s tailored to meet the unique needs of owner-operators who may occasionally drive their vehicles for personal reasons, such as running errands, visiting family, or participating in community events. By acquiring this coverage, owner-operators can ensure they remain protected and compliant with legal requirements when engaging in activities unrelated to their primary trucking business.

Bobtail Insurance: Unlocking Affordable Risk Protection

Bobtail insurance offers a cost-effective solution for owner-operators seeking liability protection while they’re off the road. Unlike traditional trucker’s insurance, which can be expensive and often unnecessary for when the vehicle is not in use or transporting goods, bobtail policies are tailored to cover specific scenarios like personal use, towing, or local hauls. This makes it an attractive option for those looking for affordable owner-operator insurance that aligns with their reduced operational needs.

By focusing solely on liability, these policies provide essential coverage without burdening the owner-operator with unnecessary expenses. Whether you’re a seasoned professional or just starting out, bobtail insurance can unlock peace of mind and financial security, ensuring you’re protected should the unexpected occur while your vehicle is not engaged in commercial trucking activities.

Exploring Cost-Effective Options for Owner-Operators

For owner-operators looking to save on costs, exploring non-trucking liability and bobtail insurance options can be a strategic move. These specialized policies are designed to fill gaps in coverage when a truck is not actually in service or engaged in transportation. By opting for affordable owner-operator insurance, operators can significantly reduce their financial exposure without compromising on protection.

Affordable owner-operator insurance typically includes liability coverage for personal and business use vehicles, offering peace of mind while keeping premiums low. This is particularly beneficial for those who occasionally drive their trucks for personal reasons or during off-hours. Such policies streamline the insurance process, ensuring that owner-operators remain protected without incurring excessive costs.

Navigating Claims and Legalities: What You Need to Know

Navigating Claims and Legalities: What You Need to Know

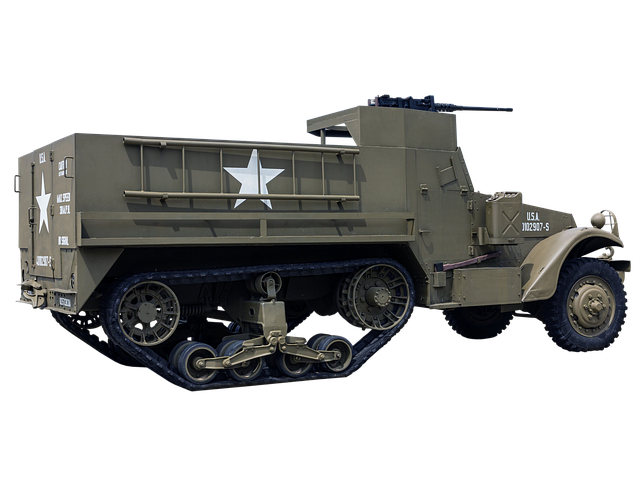

In the world of trucking, understanding non-trucking liability and bobtail insurance is crucial for owner-operators looking to protect their assets. As an owner-operator, when you’re not hauling cargo, your vehicle is considered “bobtail,” and traditional truck insurance may not cover all liabilities during this time. This is where specialized affordable owner-operator insurance steps in, offering tailored protection for those moments when the truck is idle or engaged in non-commercial activities.

To ensure compliance and minimize financial risk, it’s essential to familiarize yourself with local laws and regulations regarding non-trucking operations. Owner-operators should also be aware of specific coverage options, such as liability, collision, and comprehensive, that can address unique scenarios like personal use, maintenance, or on-site delivery services. By carefully considering these aspects, you’ll be better equipped to navigate claims and legalities associated with non-trucking activities, ultimately enhancing your peace of mind behind the wheel.

In conclusion, exploring non-trucking liability and bobtail insurance options offers owner-operators a chance to secure cost-effective coverage tailored to their unique needs. By understanding the nuances of non-trucking liability and leveraging bobtail insurance, they can navigate risks and legalities with confidence. Opting for affordable owner-operator insurance not only protects their assets but also enables them to focus on providing reliable services in today’s competitive trucking industry.